Spectacular Info About Ebit In Profit And Loss Statement Tommy Hilfiger Financial Statements

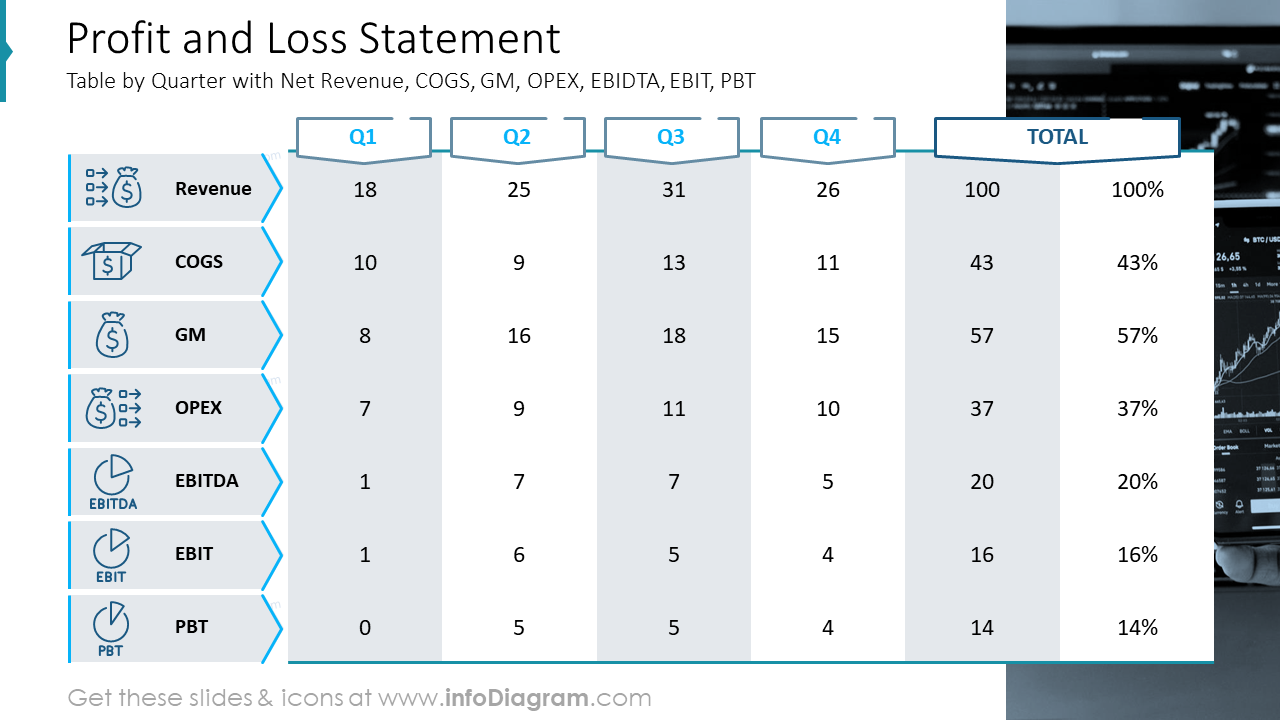

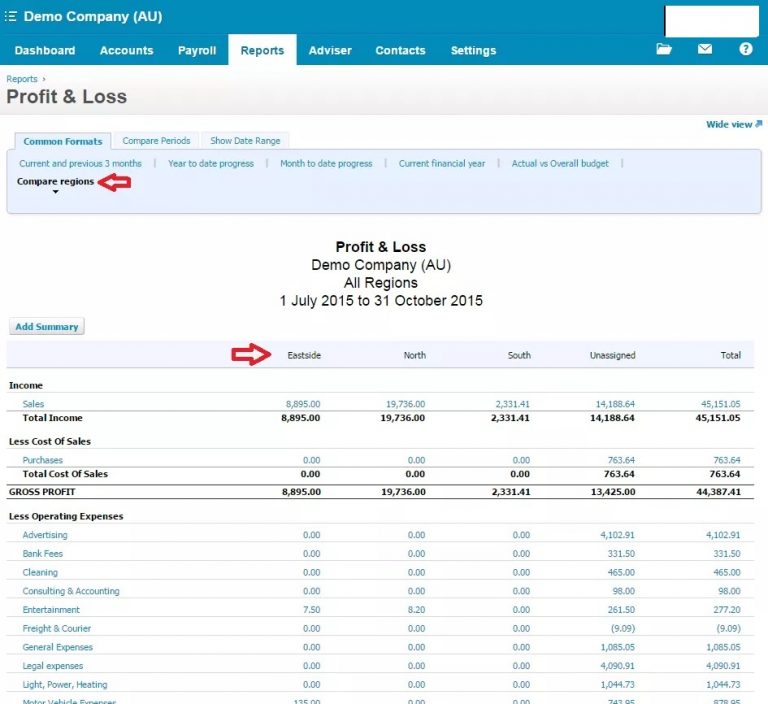

It’s usually assessed quarterly and at the end of a business’s accounting year.

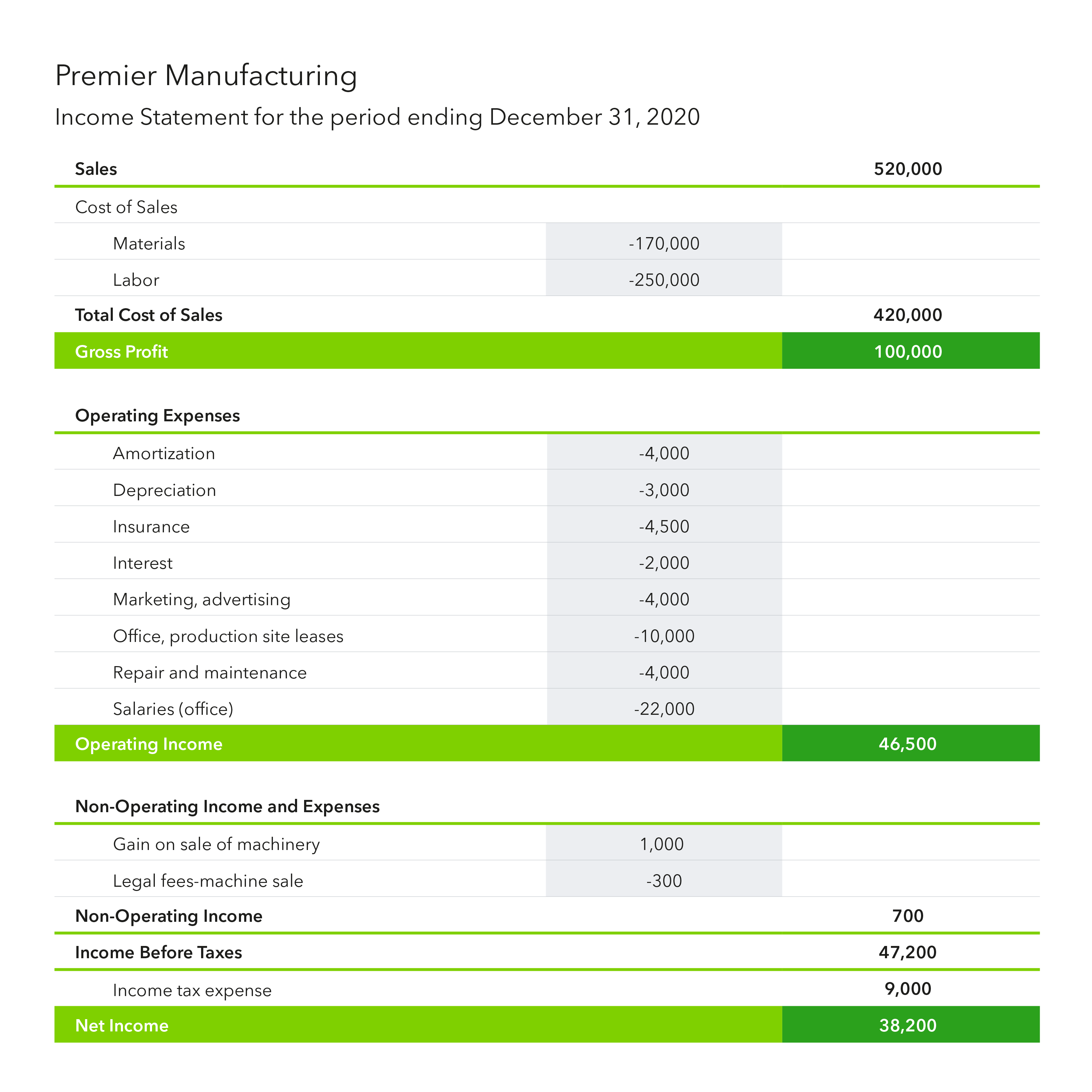

Ebit in profit and loss statement. However, it has some differences. Calculating earnings before tax on the p&l. Download the profit and loss template

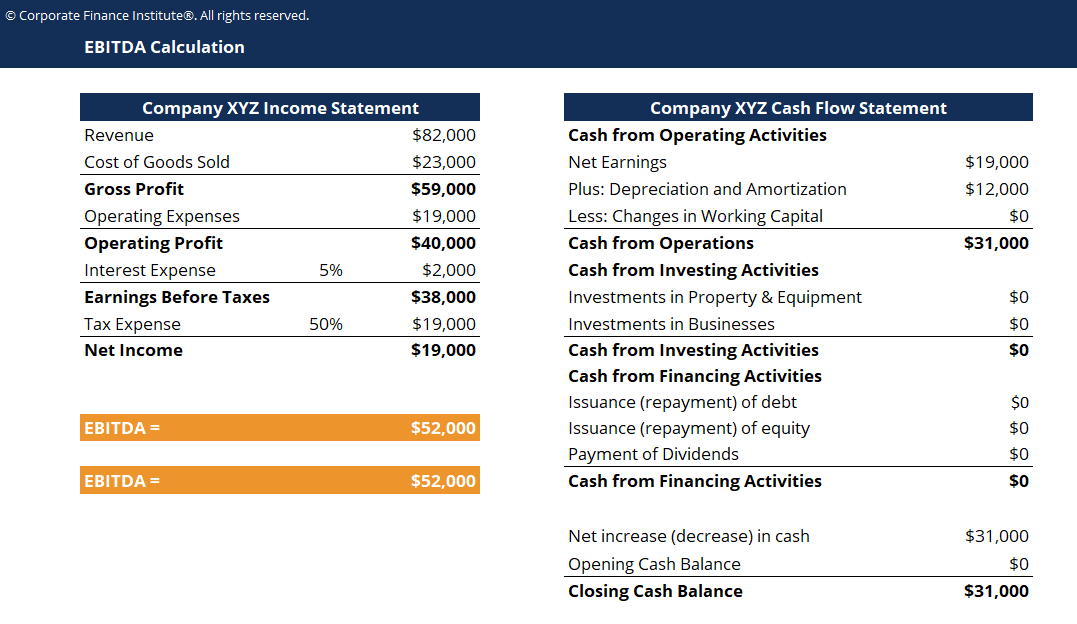

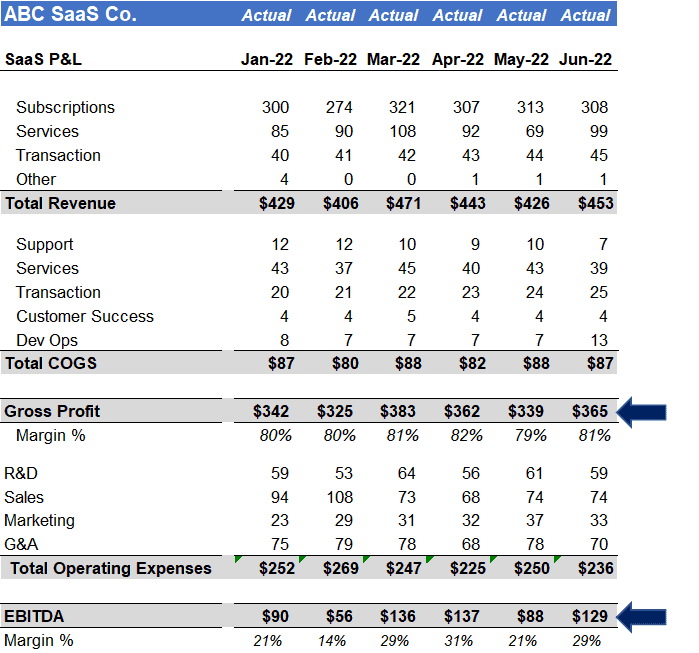

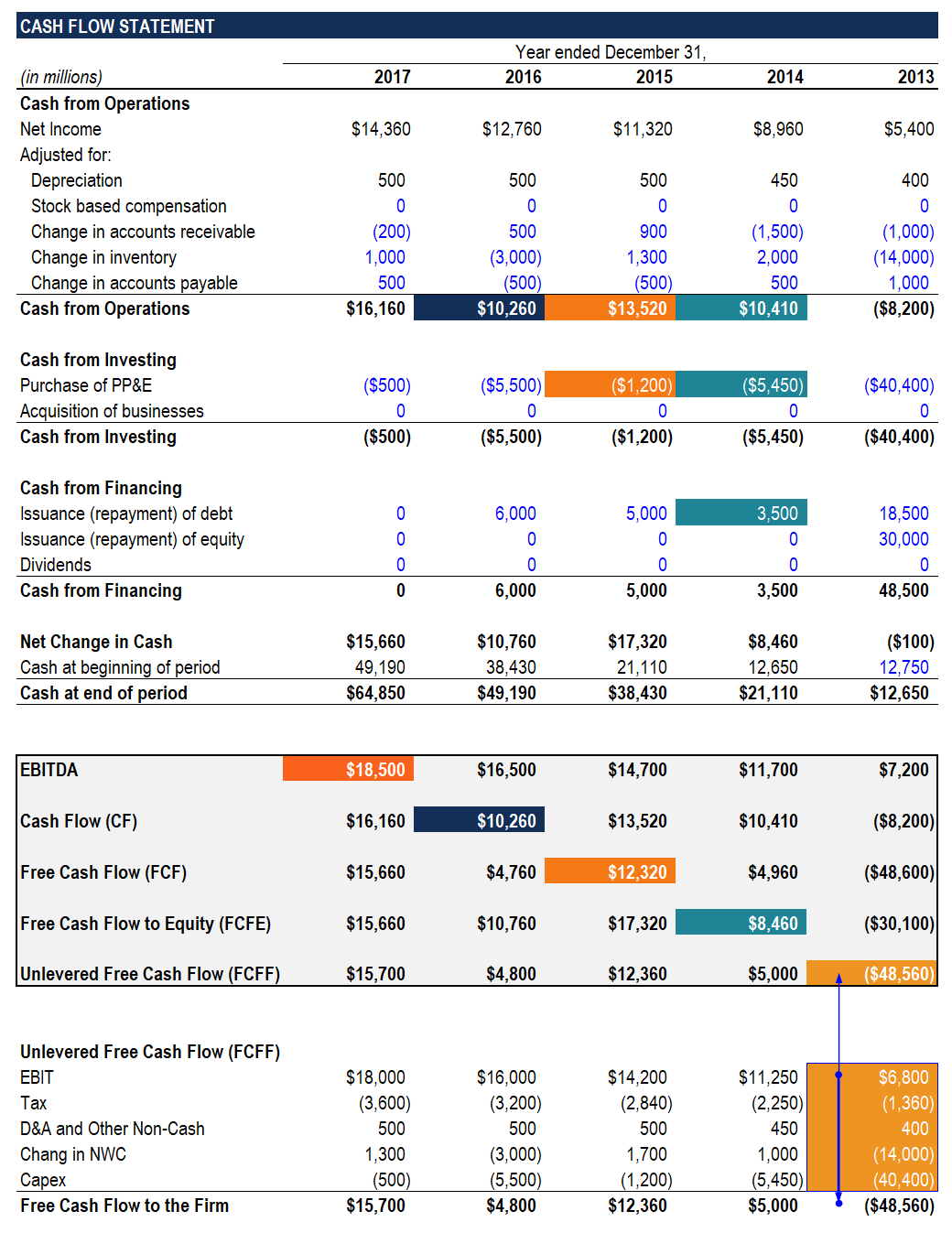

It can clearly show whether a company is making a profit or not. To learn more, read amazon’s annual report. Generate revenue → “top line” sales growth.

Think of a p&l statement as a financial snapshot, capturing your company's income and expenses over a specific period, typically a month, quarter, or year. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. All the indirect expenses and incomes, including the gross profit/loss, are reported in the profit & loss statement to arrive at the net profit or loss.

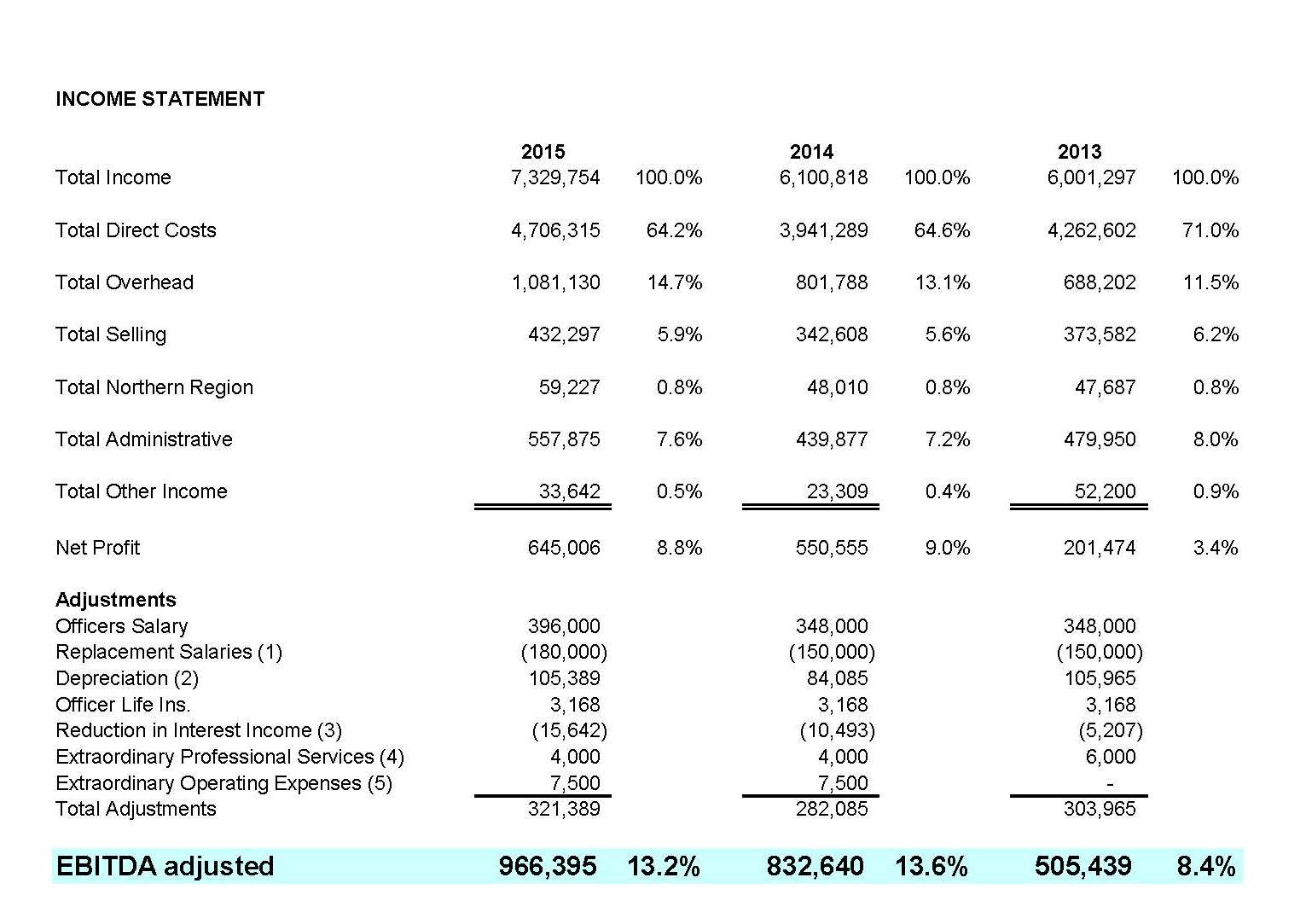

The profit and loss statement summarizes all revenues and expenses a company has generated in a given. Pascal soriot, chief executive officer, astrazeneca, commenting on the results said: The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

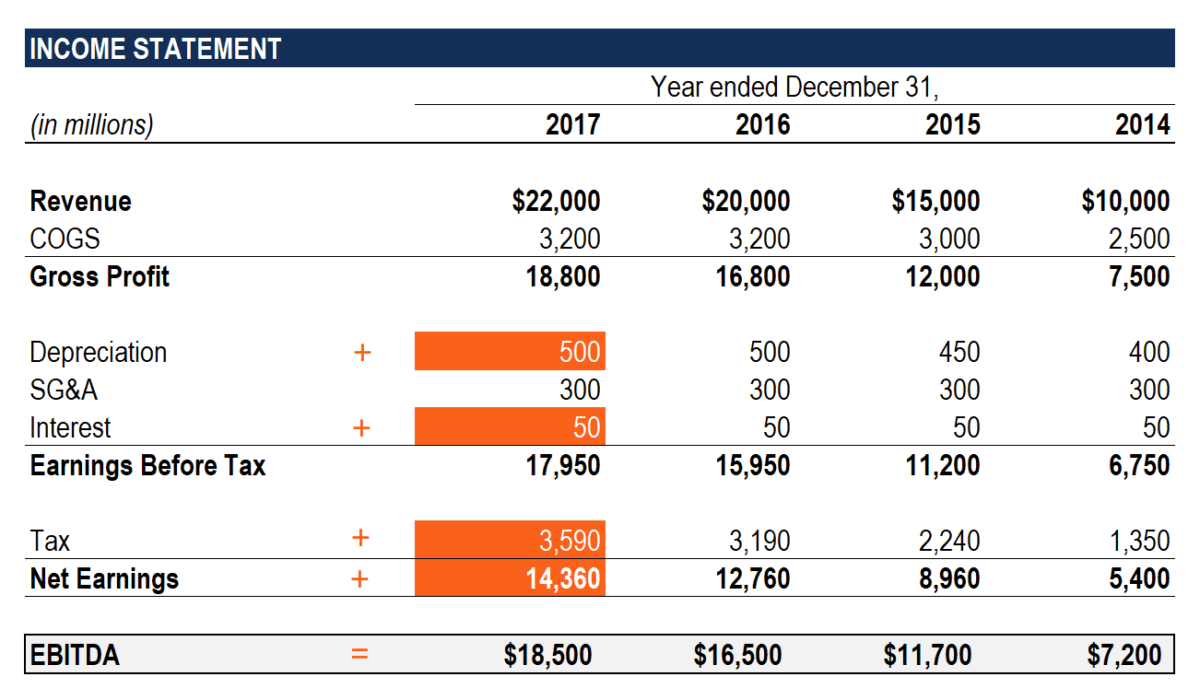

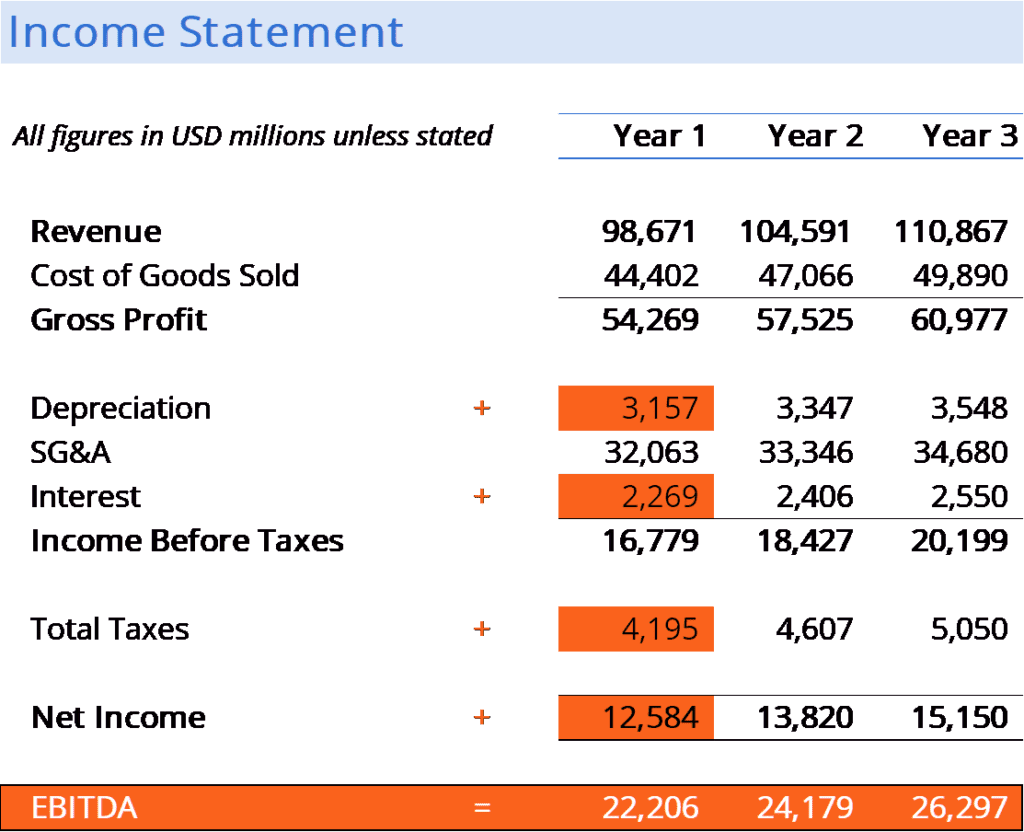

At this point, it provides a subtotal on the statement for operating income, also commonly referred to as earnings before interest and taxes (ebit). Profit before interest and tax; Cost of goods sold (cogs) and operating costs (sg&a, r&d) earn profits → e.g.

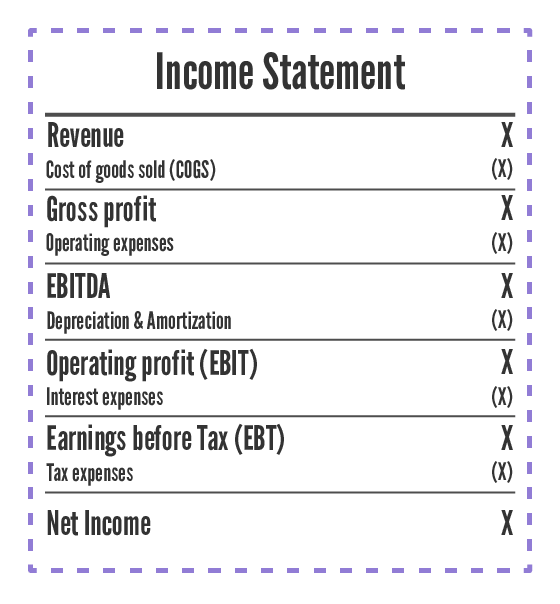

Revenue, expenses, and net income. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. It shows your revenue, minus expenses and losses.

Understand the meaning and differences of various terms found on a profit and loss statement. Upon assessing a company’s p&l statement, one can gauge the company’s ability to: A profit and loss statement contains three basic elements:

While business accounting software makes it simple to. Then, it subtracts the costs of making those goods or providing those services, like. This statement summarizes the revenue, cost of goods sold, gross profit, expenses, and net income for your company from the beginning of the year to the current date.

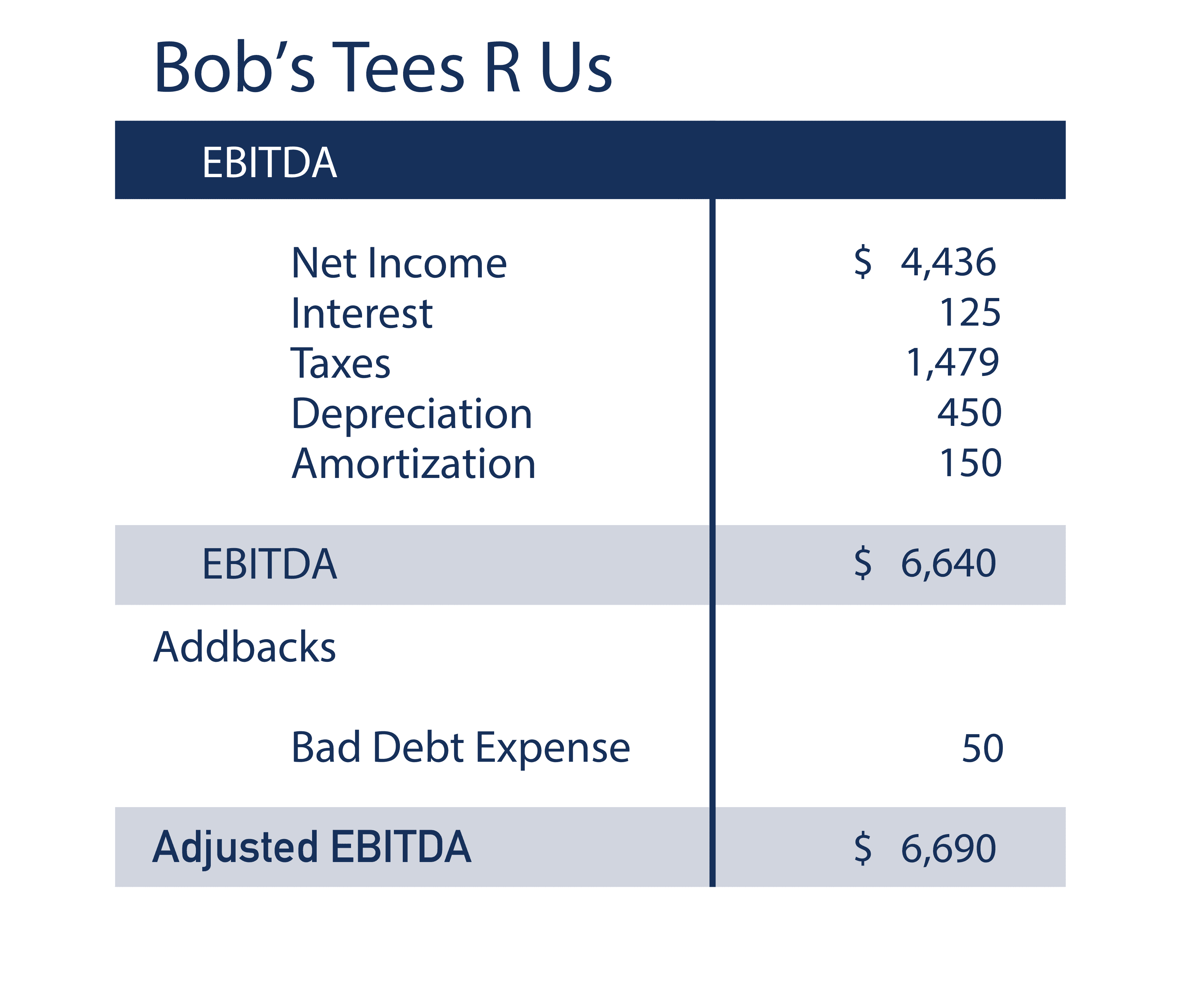

$80 million * 10% = $8million. Ebit of 4.33 billion euros declined 20.1 percent from the prior year. To calculate earnings before interest and taxes, subtract operating expenses—which include overhead costs like rent, marketing, insurance, corporate salaries, and equipment—from gross profit.

Gross profit is shown on a company’s income statement. A profit and loss statement—also called an income statement or p&l statement—is a financial statement that shows a business’s revenue, expenses, and net income over a specific period of time. Ebit, or operating profit, measures the profit generated by a company's operations.

:max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

:max_bytes(150000):strip_icc()/McDonalds-a114d966ba2047978e84ef9db2dabbff.jpeg)