Breathtaking Tips About Final Corporate Tax Return Balance Sheet Income Statement Is Also Called

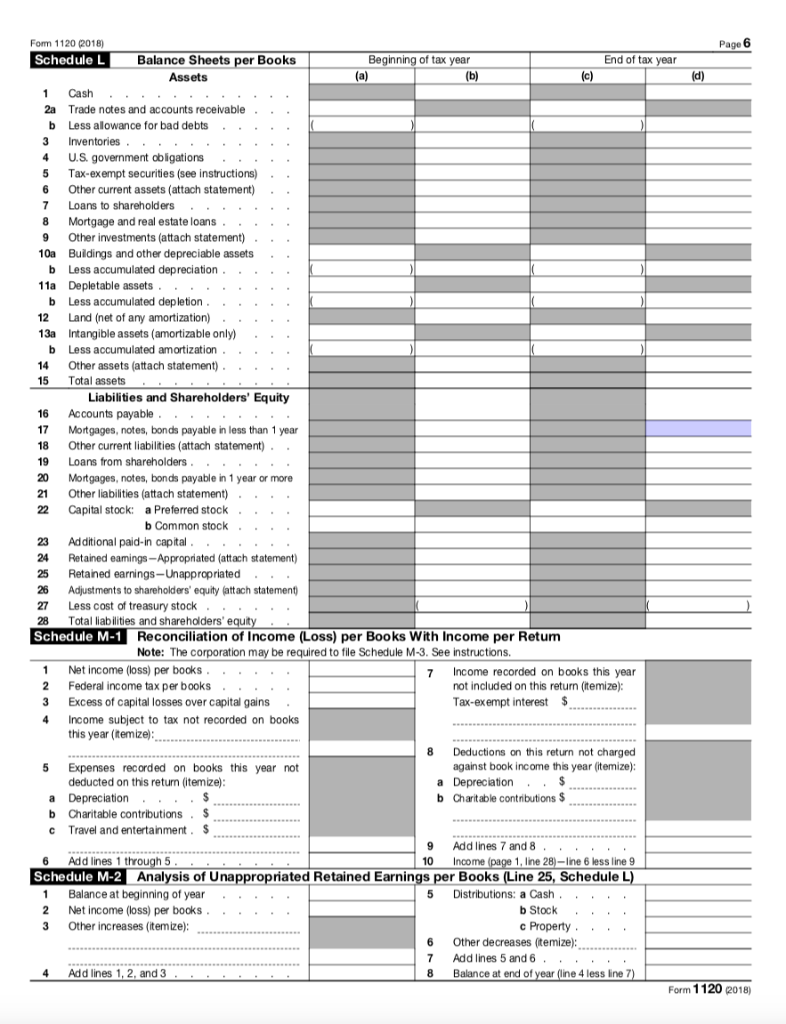

When the accrue federal tax box is checked, lacerte calculates the total tax, then credits the ending balance of prepaid federal tax (screen 37, balance sheet) up.

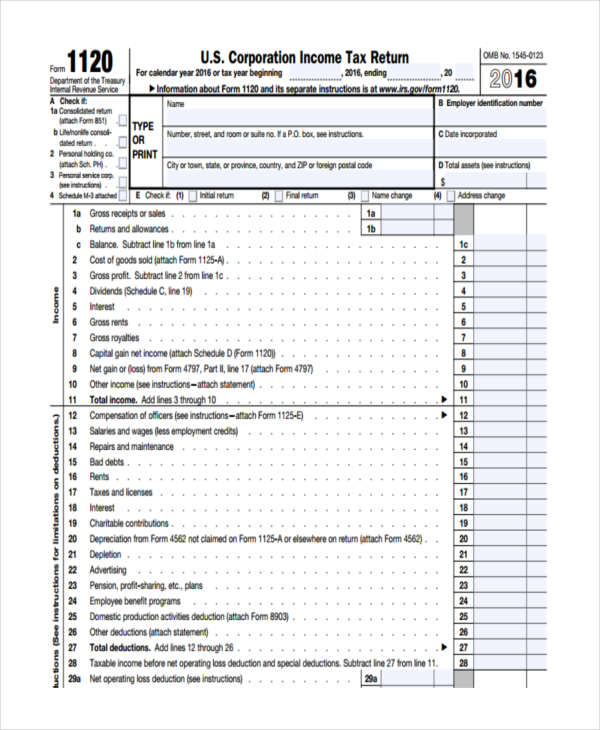

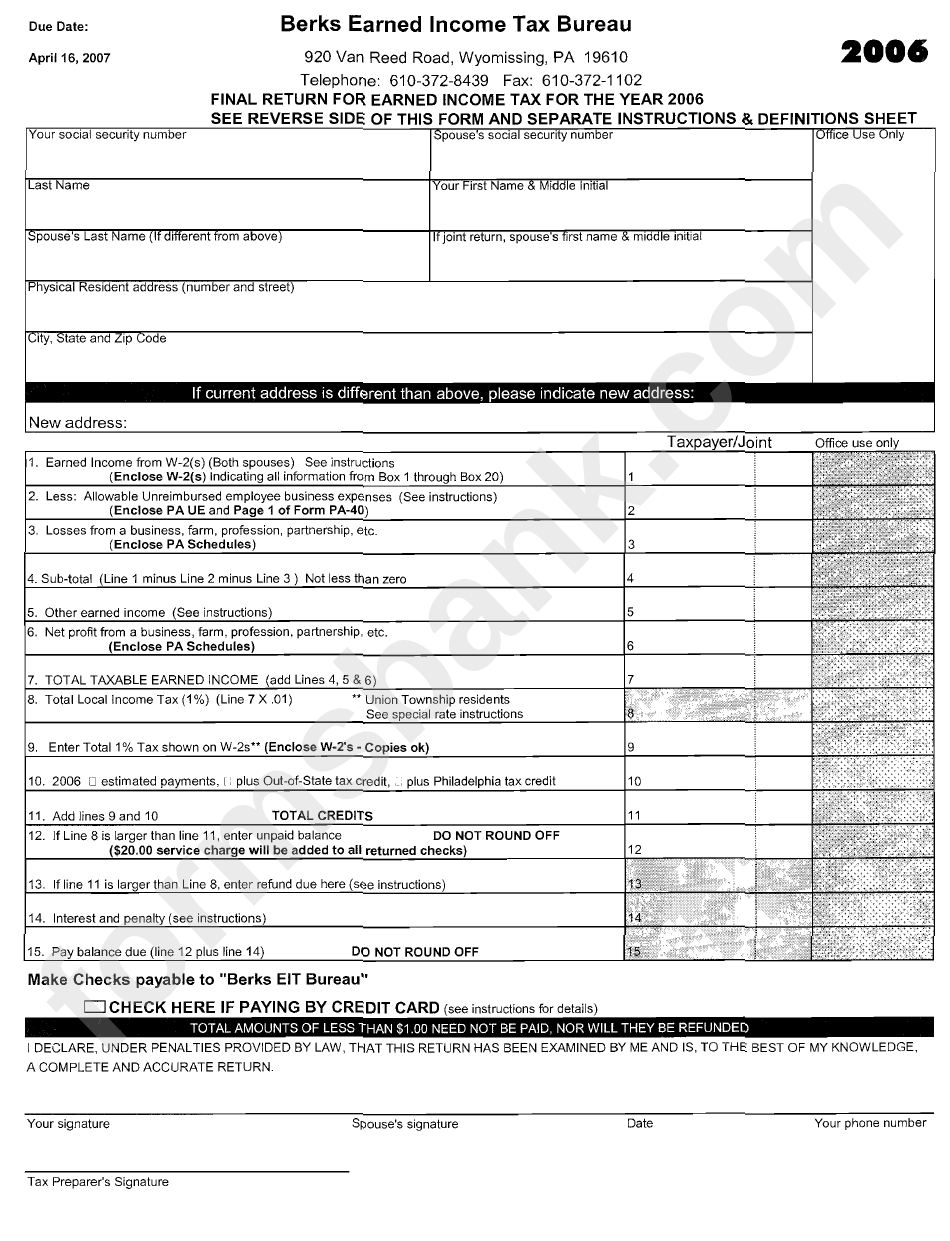

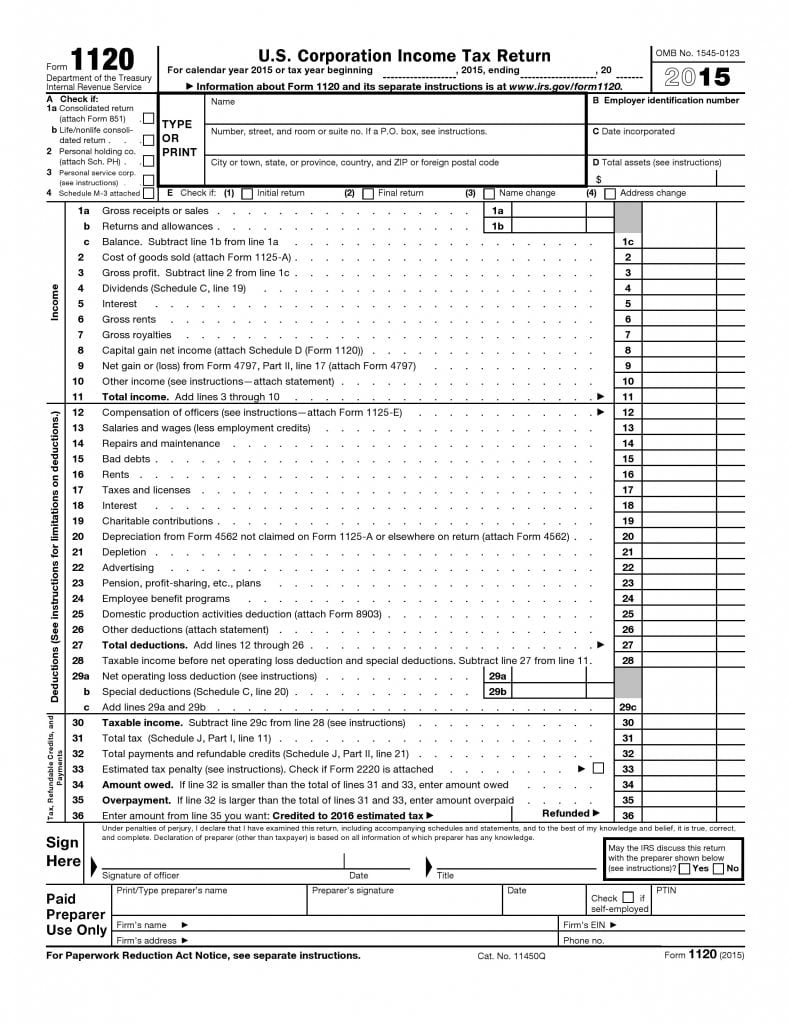

Final corporate tax return balance sheet. The cash will be used to pay the final taxes due. This indicates that you are closing the business. You'll usually find a box to check on your business tax return to indicate that it's a final return, but you'll also be able to show that your business has wrapped up successfully by.

The balance sheet at 12/31/13 has a small amount of cash, some fixed assets and some notes payable. Step 1 visit the irs website to download form 1120s and the necessary schedules and instructions. Make the final calculation.

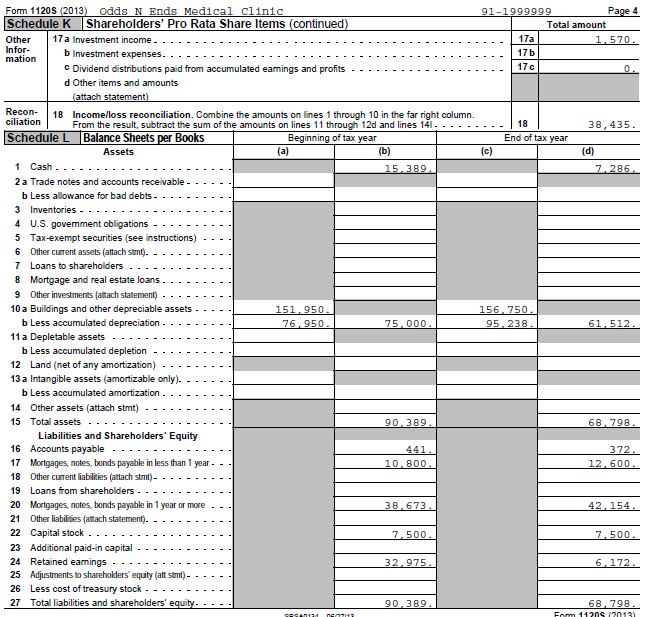

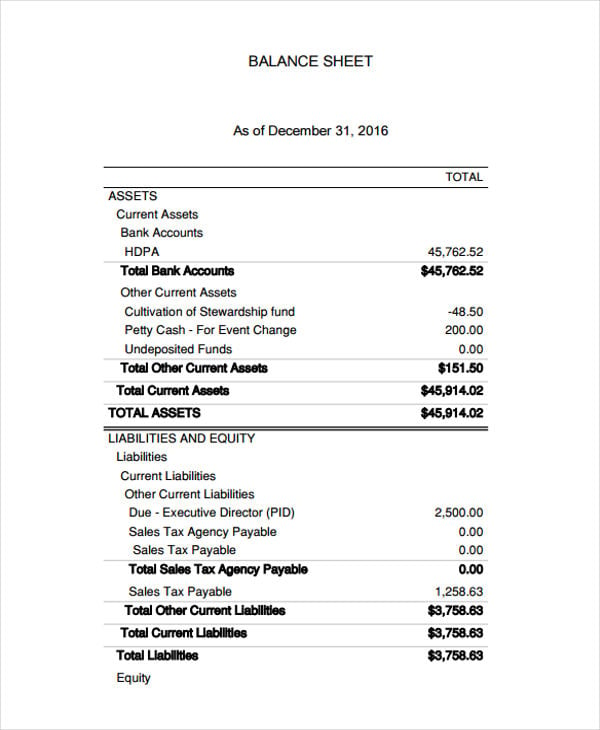

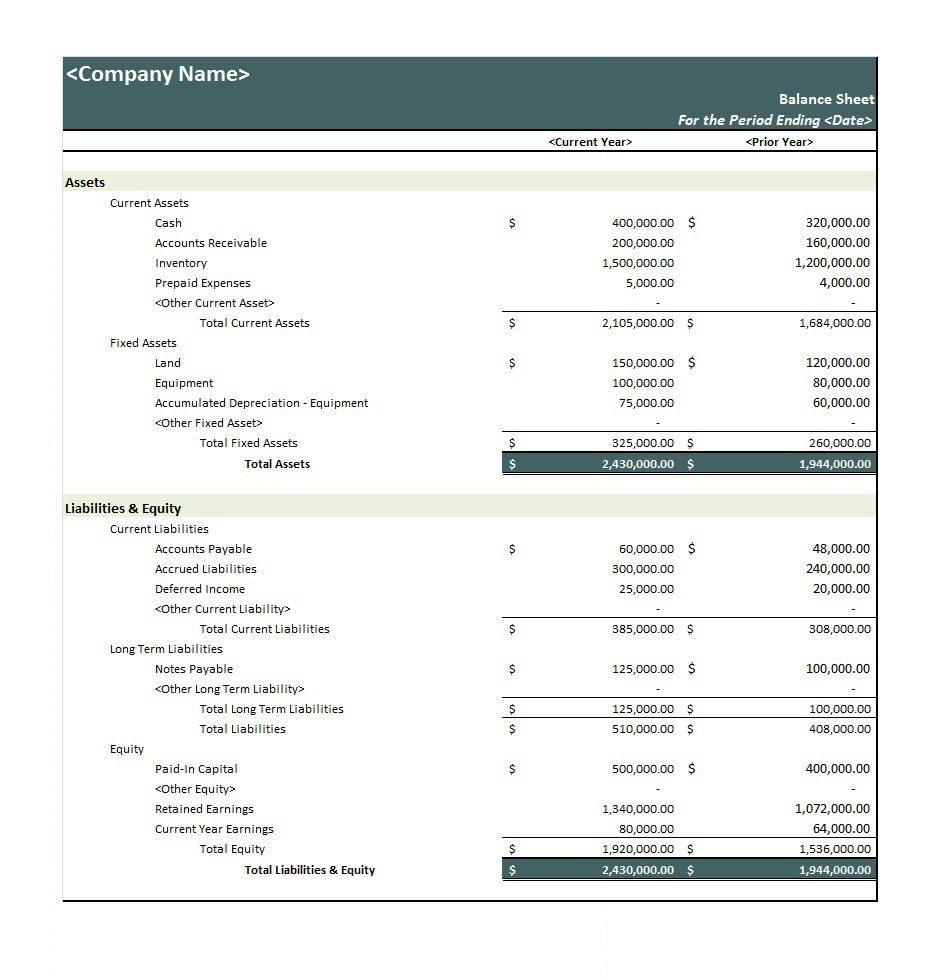

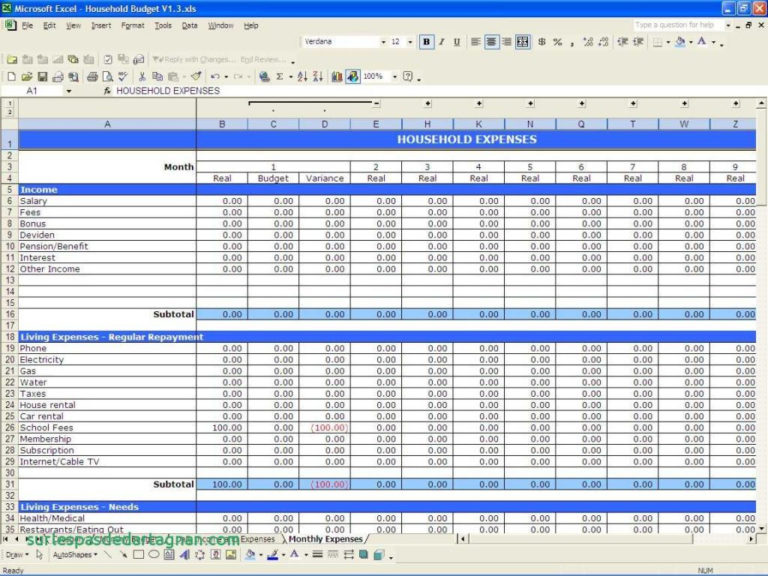

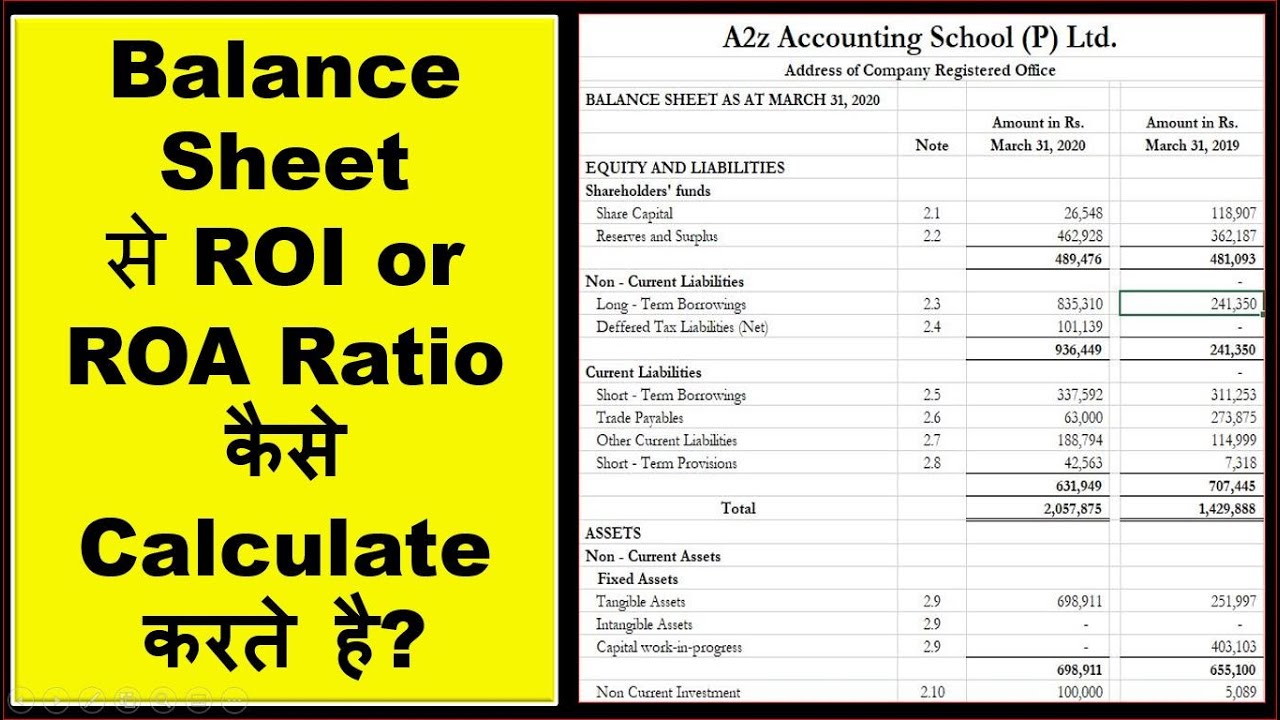

The beginning balances of the assets, liabilities and equity are the ending reported balances. Your balance sheet is in balance when the 2 sides equal each. Income tax return for an s corporation where the corporation reports to the irs their balance.

If you dissolve your partnership or corporation you will need to zero out the balance sheet on your final tax return. Mark the final checkbox on the form to indicate it is the corporation's last. You can skip the balance sheet section if all of the following are true:

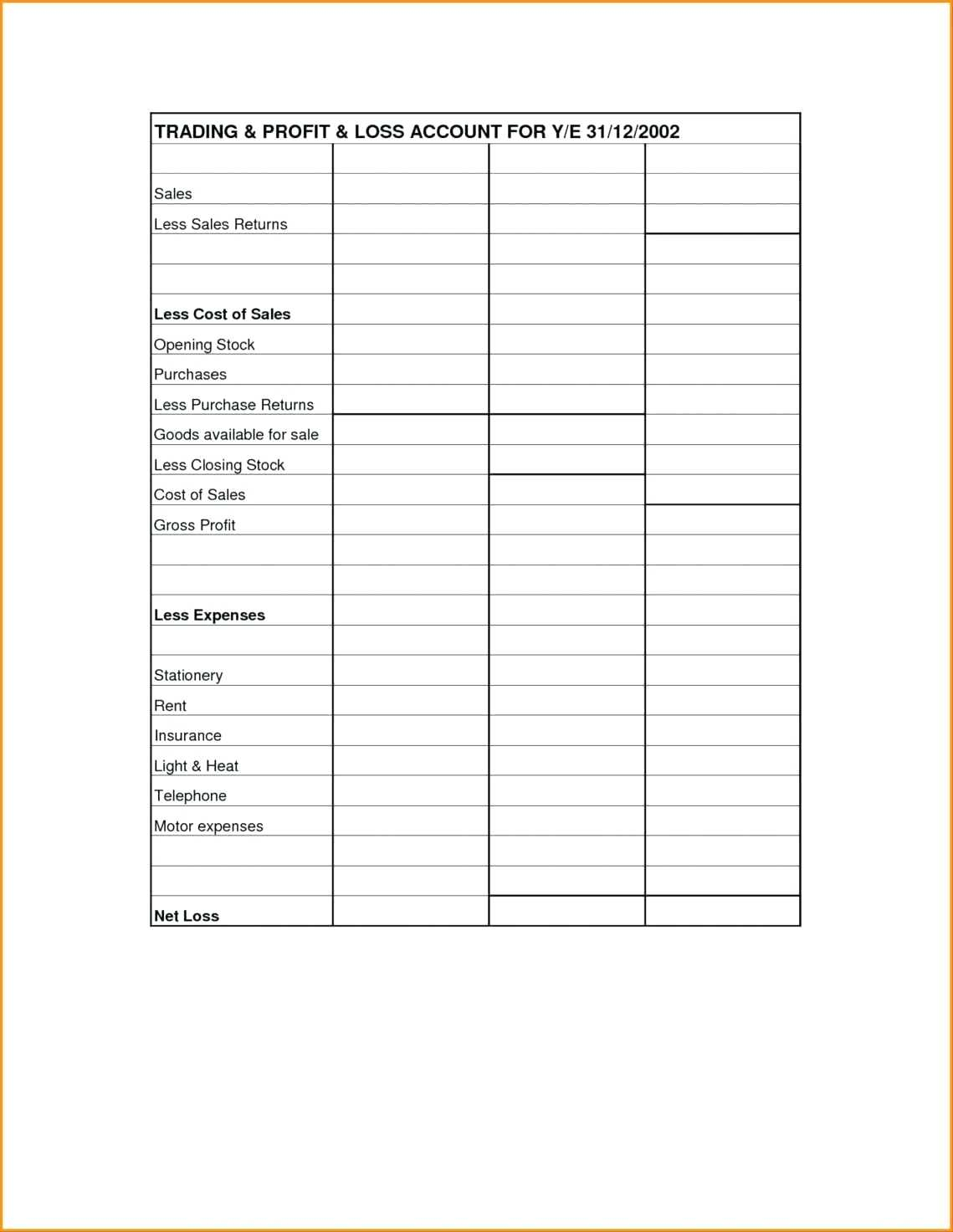

For returns on which no tax is due, the penalty is $235 for each month or part of a month (up to 12 months) the return is late or doesn't include the required information, multiplied. Calculate the sum of lines 5 and 6 and enter the total on line 7. Total business income (before deductions) is less than $250,000, and your business isn't filing.

Deduct this amount from the total on line 4. Corporations reporting taxable income on the accrual method can elect to treat as paid during the tax year any contributions paid by the due date for filing the corporation’s tax. Enter the result on line.

The corporate balance sheet is a snap shot in time of the net worth of a corporation. What to look for on any balance sheet.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)